Rich Dad Poor Dad

Table of Contents

📖 Book Review – May 2024

Title: Rich Dad Poor Dad

Author: Robert T. Kiyosaki

Finished on: May 2024

Why I Read It

Well, the first book I read was Think and Grow Rich, which was also about finance. This got me motivated to explore more books on the same topic, and thus I stumbled upon Rich Dad Poor Dad. It was also a book a lot of YouTubers recommend. So I thought, why not give it a try. The 20th Anniversary edition of the book was published in 2017; the first one was published in 1997.

Summary

Starting with predictions made in the first release of the book, which were criticized, such as:

- The rich don't work for money

- Savers are losers

- Your house is not an asset (which is true, but many people buy a house not only because of the financial aspect but also for emotional reasons)

- Discussing why the rich pay less in taxes

The reason why the rich get richer and the poor get poorer is that the subject of money is taught at home, not at school.

By asking the right question you can put your brain to work. Instead of saying words such as I can't afford it, ask the question How can I afford it? - which helps fight mental laziness and exercises your brain.

Being broke is temporary, being poor is eternal.

The rich have money work for them

You should make up your mind decisively; otherwise, you never learn to make money. Opportunities come and go, and being able to make quick decisions is an important skill.

When you face challenges you either learn from them and do well, or life will continue to push you around while you blame others. In this situation people can either:

- Learn from it and let life push them around

- Get angry and push back while affecting other relationships because they don't accept that life's challenges are part of the process

The meaning of 'The rich have money work for them' is buying assets or building them so they deliver cash flow and put money to work. While high-paying jobs seem good, in reality you are working for the money and also pay a lot of taxes on it, which increase with your salary.

People's lives are controlled by two emotions: fear and greed

Instead of trying to get rid of these emotions (emotions are what make us human), be truthful about them and use your mind and emotions in your favor. When people say I need to find a job, it is often an emotion generating this thought - fear of not having money (although some people really love their job; this is a different story - I like to code). Greed arises because you desire something, so first learn to handle your fear and desire. (Page 58.)

When emotions go up, intelligence goes down

People fear being without money, so they work hard to earn a paycheck. But once they have that money, greed sets in and they think about all the things they could buy - also called the Rat Race.

Why financial literacy is crucial

It is not how much you make. It is how much money you keep.

First of all, you must know the difference between assets and liabilities: the rich acquire assets and the poor and middle class often acquire liabilities that they think are assets. An asset puts money in your pocket while a liability takes money out of your pocket.

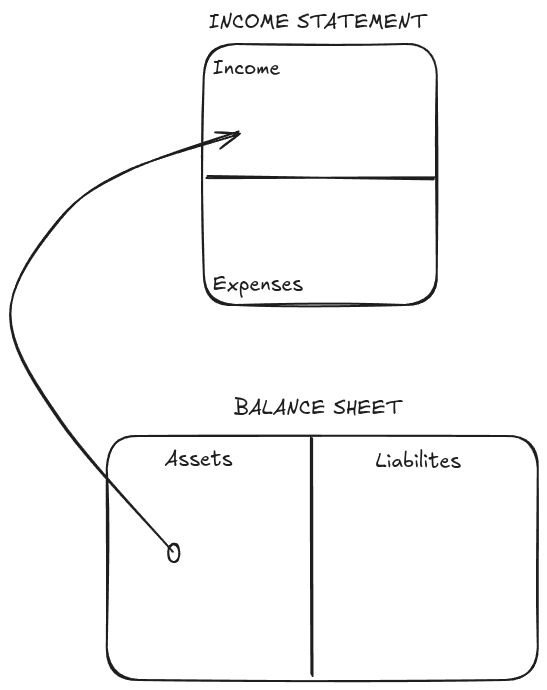

Cashflow pattern of an asset

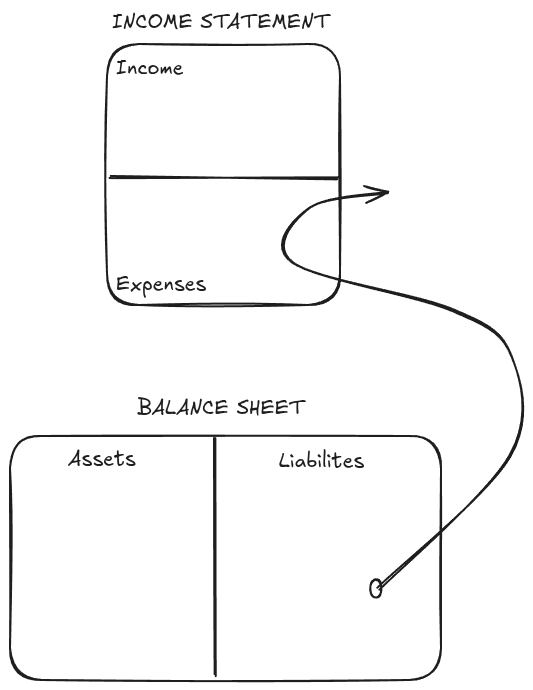

Cashflow pattern of a liability

People in the middle class typically have a job that pays a salary. The salary then goes to liabilities first - car loans, credit card debt, and so on. From the liabilities it wanders off to expenses to actually pay for the liabilities and other things. A rich person may still have liabilities but, in addition, also has assets such as stocks and bonds which pay dividends or interest. So the key difference is the assets the rich person has, which the middle class or poor person often does not.

Wealth is a person's ability to survive a number of days forward if the person stopped working.

The book contains many explanations and examples in this chapter about assets and liabilities; therefore I won't summarize the rest of it.

Minding your own business

The rich focus on their assets while everyone else focuses on their income statement

The school system focuses on preparing youth to get good jobs, and therefore you become what you study. This results in people forgetting to mind their own business and instead focusing on someone else's business and making that person richer. To become financially secure you need to mind your own business - grow your assets rather than working harder for a raise. Many people can't afford to take risks because they have no strong financial foundation, which makes them play it safe rather than trying to create something of their own. Some assets you can focus on are:

- Businesses that you own but are managed or run by other people

- Stocks

- Bonds

- Income-generating real estate

- Royalties from intellectual property (music, scripts...)

- Anything else that has value and produces income

History of taxes

Rich people often pay less in taxes. Many people in the middle class are the ones who end up paying higher taxes. The author explains the history of taxes (I won't go into the full detail), but the takeaway is that the uninformed will continue to pay more tax while the rich find ways to reduce their tax burden. Having financial IQ is crucial for achieving financial independence.

Key areas to develop:

- Accounting - the ability to read and understand financial statements to identify strengths and weaknesses of any business

- Investing

- Understanding your markets - know the technical aspects of the market (does an investment make sense?)

- The Law - the ability to understand tax advantages and protections provided by corporations (protection from lawsuits)

The rich invent money

Often in the real world, it is not the smart who get ahead, but the bold

Once you leave school and enter the real world, more than a college degree or good grades is required to decide one's future. Financial genius requires both technical knowledge and courage; if fear is too strong, the genius is suppressed. Learn to take risks, be bold, and let your genius convert fear into power. Focus on developing your financial IQ and it will prosper.

People who cling to old ideas and resist change blame technology, the economy, or their boss, while they fail to realize that they are part of the problem.

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

While developing your financial IQ and putting it to work, remember to have fun - sometimes you win and sometimes you lose. You should not be afraid of failure because it is part of success. There are two kinds of investors:

- Those who buy packaged investments from a retail outlet (financial planner...)

- Those who create investments (professional investors)

To be the second type of investor you must develop these three skills:

- Find the opportunities that everyone else missed

- Raise money

- Organize smart people (Master Mind) who have more intelligence than you

Don't work for money

Generally, people often have one skill they learned in college or elsewhere. In order to increase their income exponentially, they just need to learn and master one more skill. For example, someone who can write great books might be a brilliant writer, but without the skill of marketing/sales the person might not be able to sell any books.

You want to know a little about a lot

While job security means everything to many people, learning means everything to rich people. Also, being good at leading is an important skill you must learn in order to run your business; otherwise you might get stabbed in the back.

Just Over Broke

Think about what skills you want to learn before choosing a specific profession to avoid the Rat Race. The main skills needed for success are:

- Management of cash flow

- Management of systems

- Management of people

And some specialized skills that are important for your business are sales and marketing.

Overcoming obstacles

The primary difference between a rich person and a poor person is how they manage fear

The reasons why financially literate people still struggle to develop their assets column, which could result in a large cash flow, are:

- Fear

- Cynicism

- Laziness

- Bad habits

- Arrogance

Nobody likes to lose money, and there is not a single rich person who has never lost money. Many people fear losing money, and that is okay; everyone does. However, how you handle the fear makes the difference. Age also plays a crucial part when starting to invest, as different factors come into play at different ages. Many who lack financial success play it safe.

Note by me: This is a little bit extreme - go big whether you are losing or winning. While a rich person might lose some amount of money and still be fine, people who have jobs and receive a salary might not be able to afford such losses as it can ruin their whole life. But this all comes down to the size of the losses.

Most people don't win financially because the pain of losing money is far greater than the joy of being rich

Failure inspires winners. Failure defeats losers.

Everyone has doubts about themselves - "I'm not smart", "I'm not good enough" - and these doubts often paralyze us. People like to play the What If? game: "What if the stock crashes right after I invest?" These doubts often get so loud that we fail to act. In school we learn to avoid mistakes and if we make one we get punished. However, in the real world you should acknowledge your mistakes, evaluate them, and use them as tools to make better decisions.

Mistakes are good if we find the lesson in every failure

The doubts and cynicism keep people poor and make them play it safe.

The common form of laziness is staying busy - too busy to take care of your wealth, health, and relationships. To cure laziness you just need a little bit of greed - yes, greed. Instead of saying I can't afford it, say How can I afford it?, which forces your brain to think of solutions.

Getting started

There is gold everywhere. Most people are not trained to see it.

To find those million-dollar "deals of a lifetime" you must call on your financial genius. Everyone has one, but the problem is that it lies asleep, waiting to be called upon. So how do you develop your financial genius?

- Find a reason greater than reality - Many people like to be financially free but when reality sets in the road seems too long. Make a list of don't wants and wants for wanting to be rich. If your reason for being rich is not strong enough, reality may seem greater than your reasons.

- Make daily choices - Choice is the reason why people want to live in a free country; our spending habits reflect who we are.

- Choose friends carefully - You should not choose friends based solely on their financial status; you can learn from both kinds of friends. However, avoid taking financial advice from friends who are poor or frightened.

- Master a formula and then learn a new one - You become what you study. Once you master a formula, search for another one; even if you don't apply the information you learned, you have still learned something new.

- Pay yourself first - Once you get your salary, instead of spending it first on expenses, use it to grow your assets (balance sheet). It is not about being irresponsible (by not paying your bills); even a little amount is enough to grow your assets. To achieve this make sure you don't get into large debts and when you come up short don't dip into your savings; instead think of making more money.

- Pay your brokers well - If you have any accountants, real estate or stock brokers, or other professionals whose services make you money, make sure to pay them well as their information is making you a lot of money.

- Be an Indian giver - The investor's first question: How fast do I get my money back?

- Use assets to buy luxuries

- Choose heroes - Have heroes to inspire you to achieve what they have: If they can do it, so can I

- Teach and you shall receive - Give what you want first and it will come back in buckets.

Your to-dos

- Stop doing what you are doing - Take a break and assess what is working and what is not; stop doing what is not working and look for something new.

- Look for new ideas.

- Find someone who has done what you want to do - Take them to lunch and ask them for tips and tricks of the trade.

- Take classes, read, and attend seminars.

- Make lots of offers - Make lots of offers for something you want if you don't know the exact price.

Well, this is all about the book. There are many detailed writings in the book, which I have skipped for obvious reasons, but I hope you got a rough overview of the book.

Personal Reflection

I find the book really good, especially for learning the key difference between assets and liabilities, which I knew before reading it but not in depth. This book motivated me to start growing my assets (which I am currently doing even though it is not much).

Would I Recommend It?

Absolutely - you should read it at least once.

Looking Ahead

My upcoming book is The 48 Laws of Power, which should be interesting.